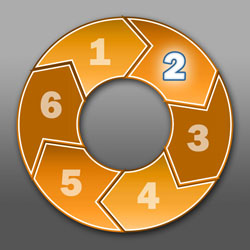

The Real Estate Life Cycle

The process of owning and profiting from commercial real estate is more complicated than buying and selling.

Identification

Our culture of decentralization and partnership appeals to individuals and entities that own or control attractive real estate opportunities, but lack either the capital or the expertise to unlock their potential.

Evaluation

We conduct a thorough analytical evaluation of every deal in order to develop a complete understanding of its costs, risks, timing, financial upside, and exit strategy. We possess many years of experience in property underwriting and proprietary financial modeling, and frequently find hidden sources of value during due diligence.

Acquisition

By understanding a target property as well as its seller, we gain precise knowledge of its worth, along with useful negotiating leverage. We establish our pricing threshold going in, and if we don’t beat it, we don’t close. As was the case in 2006, we will completely exit a market or sector, or all markets and sectors, if conservative pricing cannot be achieved.

Renovation

We know that as assets age their layout and configuration may no longer be responsive to market desires, requiring a modernization program or a change of use. Depending upon the magnitude of the renovation, this step is often the single greatest contributor to overall profit. Note, for development transactions, this phase is called Construction.

Cultivation

Perhaps our greatest point of differentiation is the special attention paid to the day-to-day asset management of properties we acquire. Like a farmer, who tends to his crops in order to produce a more abundant harvest in the future, we continuously manage fund assets in order to increase their marketability at disposition.

Disposition

Properties are acquired and managed to generate stable cash flows as soon as possible, thereby allowing the properties to carry themselves until market conditions signal appropriate disposition timing. We prefer not to sell assets in pools, so that each individual property can be sold at the most advantageous time for the property rather than the portfolio, avoiding bulk sale discounts.